car insured laws accident insurance affordable

car insured laws accident insurance affordable

This suggests that it pays the cost of problems after a crash that you create. This includes:: Covers clinical bills as well as lost salaries for various other vehicle drivers as well as their passengers: Covers the expense of problems to other celebrations' automobiles and also property Obligation insurance coverage does not spend for problems to your own individual, travelers or lorry.

0 We at the House Media examines group rate USAA simply as highly as Geico, and for a lot of the same reasons. cheapest car insurance. The only disadvantage to USAA is that it is not offered for all drivers. In order to be qualified for a plan with USAA, you need to be an armed forces participant or have a family members member with a USAA account.

cheaper auto insurance insurance company insurance company vehicle insurance

cheaper auto insurance insurance company insurance company vehicle insurance

Right here are the variables our scores take right into account: Price (30% of total rating): Car insurance coverage rate quotes created by Quadrant Details Services and also price cut opportunities were both taken into consideration. Insurance coverage (30% of total rating): Firms that use a range of choices for insurance protection are most likely to fulfill consumer requirements.

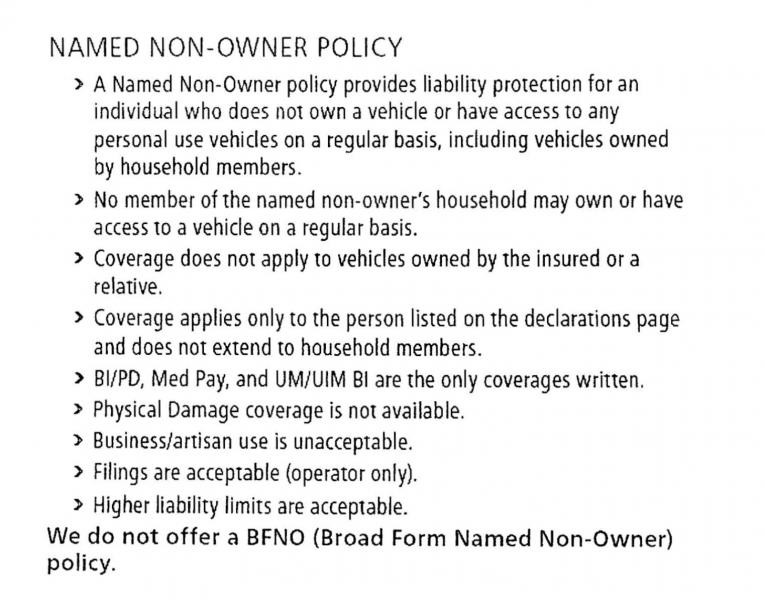

If you borrow or rent out cars frequently, use car-sharing solutions like Zipcar or require to submit an SR-22 or FR-44 without a vehicle, non-owner auto insurance policy could be ideal for you - liability. Non-owner auto insurance coverage is an insurance coverage plan for individuals without a vehicle.

7 Simple Techniques For What Is A Non-owner Car Insurance Policy?

What does non-owner auto insurance policy cover? Non-owner auto insurance policy liability protection covers injury to others as well as residential property damage.

Exactly how does non-owner car insurance policy job? Non-owner cars and truck insurance plans just cover damage if the primary policy's protection limitation is less than the additional coverage.

If your friend has $60,000 of home damage insurance coverage or even more, your non-owner policy does not apply. Where to acquire non-owner vehicle insurance Many business that market traditional auto insurance policy also sell non-owner car insurance, but simply don't promote it online. Some insurers, like Progressive, only offer non-owner automobile insurance coverage to you if you are already an existing customer.

car insured automobile credit score business insurance

car insured automobile credit score business insurance

To discover your least expensive auto insurance coverage company, we advise comparing quotes from a handful of business. Connect with an agent today to get a non-owners policy After registering for a policy, you need to get either physical or digital evidence of coverage. Just how a lot does non-owner automobile insurance coverage expense? Non-owner automobile insurance coverage typically costs $400 to 600 a year, or about the like auto responsibility insurance coverage.

The smart Trick of What Is Non-owner Car Insurance And Do You Need It? That Nobody is Discussing

Most car-sharing companies offer motorists some obligation protection, it might not be enough for you. You require an SR-22 or FR-44 If you need to file an FR-44 or SR-22 form with your state due to a DUI or other driving conviction, non-owner coverage could be a cheap means for you to satisfy your liability insurance needs (car insurance).

To avoid every one of that, think about buying non-owner coverage. cheap auto insurance. In the scope of things, it may be cheaper to be continuously covered under non-owner automobile insurance as opposed to leaving a space in your coverage. You sold your auto however have not replaced it If you sold your vehicle and haven't https://objectstorage.us-phoenix-1.oraclecloud.com/n/id0futkc0ufd/b/car-insurance-north-riverside-chicago-il/o/car-insurance-north-riverside-chicago-il%2Findex.html acquired a brand-new one, non-owner automobile insurance policy can prevent a gap in coverage.

That shouldn't get non-owner cars and truck insurance coverage? Getting non-owner car insurance policy may not be the very best suggestion if you do not rent out or obtain autos often, or if you plan to obtain a car for a while - cheaper car. You're borrowing a car for an extensive period Non-owner auto insurance coverage most likely won't cover you if you borrow a lorry for a prolonged duration of time.

The most effective means to shield yourself in this scenario is to have that individual add you to their car insurance coverage (low-cost auto insurance). Rarely obtain or lease cars and trucks As opposed to acquire non-owner cars and truck insurance in this situation, take into consideration making use of: The protection the rental or car-sharing company offers. The lorry owner's insurance coverage.

Not known Facts About Auto Insurance

All web content and also services supplied on or through this website are given "as is" and also "as readily available" for use. Quote, Wizard.

Just How Much Does Non-Owner Cars And Truck Insurance Policy Price? Non-owner automobile insurance policy is usually much less costly than a conventional liability policy.

low cost insurance cheaper auto insurance cheaper

low cost insurance cheaper auto insurance cheaper

Many rental automobile firms need, by legislation, that you supply at least the state minimum responsibility protection when driving their automobiles. Is Non-Owner Cars And Truck Insurance Policy for You?

cheaper auto insurance affordable car insurance cheapest car insurance insurance company

cheaper auto insurance affordable car insurance cheapest car insurance insurance company

Non-owner cars and truck insurance policy supplies liability protection for residential property damage or bodily injury to others if you are located responsible in an automobile accident. It does not give insurance coverage for you. Non-owner vehicle insurance coverage is a great choice for individuals who don't have an automobile however drive commonly, such as those who frequently drive rental cars and trucks. cheap car.

Everything about Why Non Owner Car Insurance For Businesses - Nationwide

The most affordable extensively available insurance firm is GEICO, where an average non-owner vehicle insurance plan costs $455 per year. What Is Non-Owner Auto Insurance Coverage? Just how Much Does It Price? Non-owner vehicle insurance policy, additionally called non-owner liability insurance policy, covers building damages and also physical injury for others if you are located responsible for the vehicle mishap when driving a vehicle that is not your very own (cheapest auto insurance).

Nevertheless, it is only offered to energetic and retired armed forces participants as well as their family members. For other consumers, the firms that rank as the cheapest in one of the most states include: Cheapest in 31 states Cheapest in 11 states Cheapest in 4 states Cheapest in 3 states Cheapest in 1 state Cheapest in 1 state, Scroll for even more Show much more, The Cheapest Non-Owner Car Insurance Policy for Drivers with an SR-22For chauffeurs that have actually dedicated a significant driving infraction, such as a DRUNK DRIVING, you might require evidence of insurance coverage, or an SR-22, to obtain your vehicle driver's license restored.

To obtain a non-owners insurance policy quote, you will need to call and speak with an insurance coverage agent. Who Demands Non-Owner Auto Insurance?

Non-owner vehicle insurance policy also gives satisfaction when driving a friend or neighbor's vehicle especially if you get into a crash where you are at mistake. But maintain in mind, non-owner vehicle insurance policy might not cover you if you deal with the person whose vehicle you obtain or if you borrow the very same automobile regularly.

How Non-owner Car Insurance In Massachusetts can Save You Time, Stress, and Money.

Non-Owner Insurance Coverage Is Excellent If You Need Low-Cost Evidence of Insurance, If you have a severe website traffic violation on your driving document as well as you've had your chauffeur's permit put on hold, you may need to send proof of automobile insurance an SR-22 before the state will renew it. Since it's cheaper than normal vehicle insurance policy, non-owner cars and truck insurance coverage can be a budget-friendly alternative to satisfy this need.

Your vehicle insurance provider need to file it in your place (credit). Given that not all auto insurance companies fund an SR-22, you'll intend to confirm they offer this as component of your coverage before going with their non-owner insurance coverage policy. When Non-Owner Cars And Truck Insurance Does Not Make Good Sense, Non-owner cars and truck insurance is not a good alternative if you do not own an auto as well as hardly ever drive.

Inexpensive Non-Owner Car Insurance coverage was last customized: March 23rd, 2022 by host1stop Find the Least expensive Non-Owner Car Insurance Calmness Insurance has guaranteeing chauffeurs utilizing Non-Owner Cars and truck Insurance. Conserve large with from Peacefulness Insurance coverage.

You don't own an automobile, yet you still need cars and truck insurance. This appears like the worst of both globes, however having non-owner's insurance can aid you save money in the lengthy run (insurance companies).

The Buzz on Non-owners Auto Insurance & Sr-22s - Faqs - David Pope

Non-owner SR22 auto insurance policy will certainly be a great deal a lot more pricey than a normal non-owner's policy, for circumstances. A lot of business do not provide non-owners vehicle insurance policy quotes online you need to call. To see to it you obtain the very best offer, below's what we suggest. First, obtain individualized insurance coverage quotes on . When we ask you about the cars and truck you drive, just get in the information for the automobile you use frequently.

Is it possible to acquire vehicle insurance even if you don't have an automobile? Absolutely! For those unusual-- but essential-- celebrations, your finest option is a non-owner auto insurance coverage plan. What is Non-Owner Automobile Insurance? In Charlotte, non-owner auto insurance policy protection is a special auto insurance coverage for drivers who don't own a lorry or do not stay in a family with someone that has a lorry. vehicle insurance.

Insurance coverage usually includes: Obligation insurance Medical insurance coverage for on your own Uninsured/underinsured motorist insurance coverage When Do You Required Non-Owner Cars And Truck Insurance Policy? There are numerous scenarios where this sort of insurance coverage is needed.: North Carolina law states that anyone that intends to get their vehicle driver's license needs evidence of insurance policy first. If you don't have a car and also aren't listed on an additional driver's plan (like a moms and dad or spouse), a non-owner car insurance coverage will certainly satisfy this legal demand (vehicle insurance).

To do that, you need to be able to reveal that you have auto insurance policy (cars). For motorists who do not own a vehicle, this can be accomplished with a non-owner policy.: Whether for work or for pleasure, if you're regularly renting out vehicles, you may be investing way too much on liability protection from the rental firm.

How Non Owner Car Insurance Quote - Direct Auto Insurance Today! can Save You Time, Stress, and Money.

You'll still need protection for any damage you do to the rental vehicle.: If you're a constant customer of car-sharing solutions, a non-owner plan could shield you if you remain in a mishap and also the other celebration gets hurt. The car-share business should have enough responsibility protection, but your policy will function as a supplement if you're named in a claim after the crash.

Every time you drive without having any type of, or poor insurance coverage, you placed yourself at risk for severe financial loss. If you obtain right into a mishap, whether it's your fault or no fault of your very own, you can be held responsible for any type of injury or problems that result from the case.

There are several noticeable benefits you obtain from having a non owners cars and truck insurance plan, with basic insurance coverage that consists of: Having liability security covers you from being demanded problems consisting of injury, loss of property and discomfort and also suffering by other events included if you have an accident. If you receive physical injuries that need clinical interest or a hospital stay while covered by non proprietor insurance policy, the payments are covered by the policy (automobile).